If you are conducting a business and unless you are a government agency or exempt company (sales from 2022 is below RM500,000), you are required to issue e-invoices in the following phases based on your sales value for 2022 and later:-

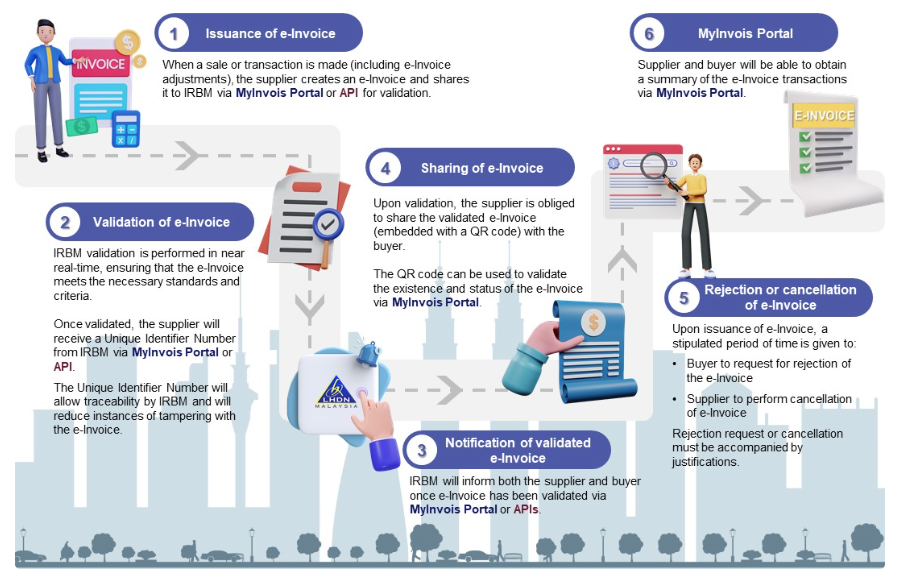

What is e-invoicing? The chart from the Inland Revenue Board of Malaysia (IRBM) below describes the process:-

What are e-invoices?

E-invoices do not just cover sales invoices that you issue. They are also include credit notes (used to reduce the amount of a previously issued sales invoice), debit notes (used to increase the amount of a previously issued sales invoice) and refund notes (used for paying back a debtor who has fully paid their net sales invoice).

Then, there are self-billed e-invoices, which are e-invoices you issue yourself to record purchase transactions from sellers who will not issue you a purchase invoice because they are either foreigners or individuals who are not conducting a business.

Self-billed e-invoices cover self-billed purchase invoices, self-billed credit notes (raised to increase the amount of a previously issued self-billed purchase invoice), self-billed debit notes (for decreasing the amount of a previously issued self-billed purchase invoice) and self-billed refund notes (used for receiving a refund from a seller for a net self-billed purchase invoice).

What software are affected by the e-invoicing requirement?

If you use a software to issue invoices, bills or receipts to recognise income and buy stuff for business expenses, that software will have to be upgraded for e-invoicing.

Do you have to issue an e-invoice to a buyer?

Yes, where a buyer requires an e-invoice. If the buyer does not need an e-invoice, you can just issue a normal invoice or receipt. Within seven days after the end of the month, you consolidate all those transactions which are not e-invoices and submit them as a single unit to the MyInvois portal to convert them into a consolidated e-invoice.

In the event the buyer changes his or her mind about getting the e-invoice, they can request for it before the end of the month. You will have to accede to their request. The buyer will not be able to convert a transaction to an e-invoice after the end of the month.

What are the differences between using MyInvois Portal and the API to submit your e-invoices?

The MyInvois portal is used by taxpayers who wish to submit e-invoices manually. They log into the portal and enter or upload their transaction details. If the data submitted is correct, they will get their e-invoice. Otherwise, they will have to correct any errors and repeat the process again.

With the API (Application Programming Interface) method, your accounting or POS (Point-of-Sale) program will handle the process of submission automatically or on demand by you. There will not be any errors in submission because the software will take care of data validation before the data is submitted to the MyInvois portal. You should not have to wait long to get the validated e-invoice.

It is obvious that using the MyInvois portal directly to submit your e-invoices manually will be time-consuming and prone to errors. You will also expect the process to be slow due to congestion because you are talking about millions of taxpayers accessing the portal at the same time.

CARAT+ Combo has been e-invoicing compliant since 1st January 2025 and solves all your e-invoicing requirements easily and simply in a cost effective way.